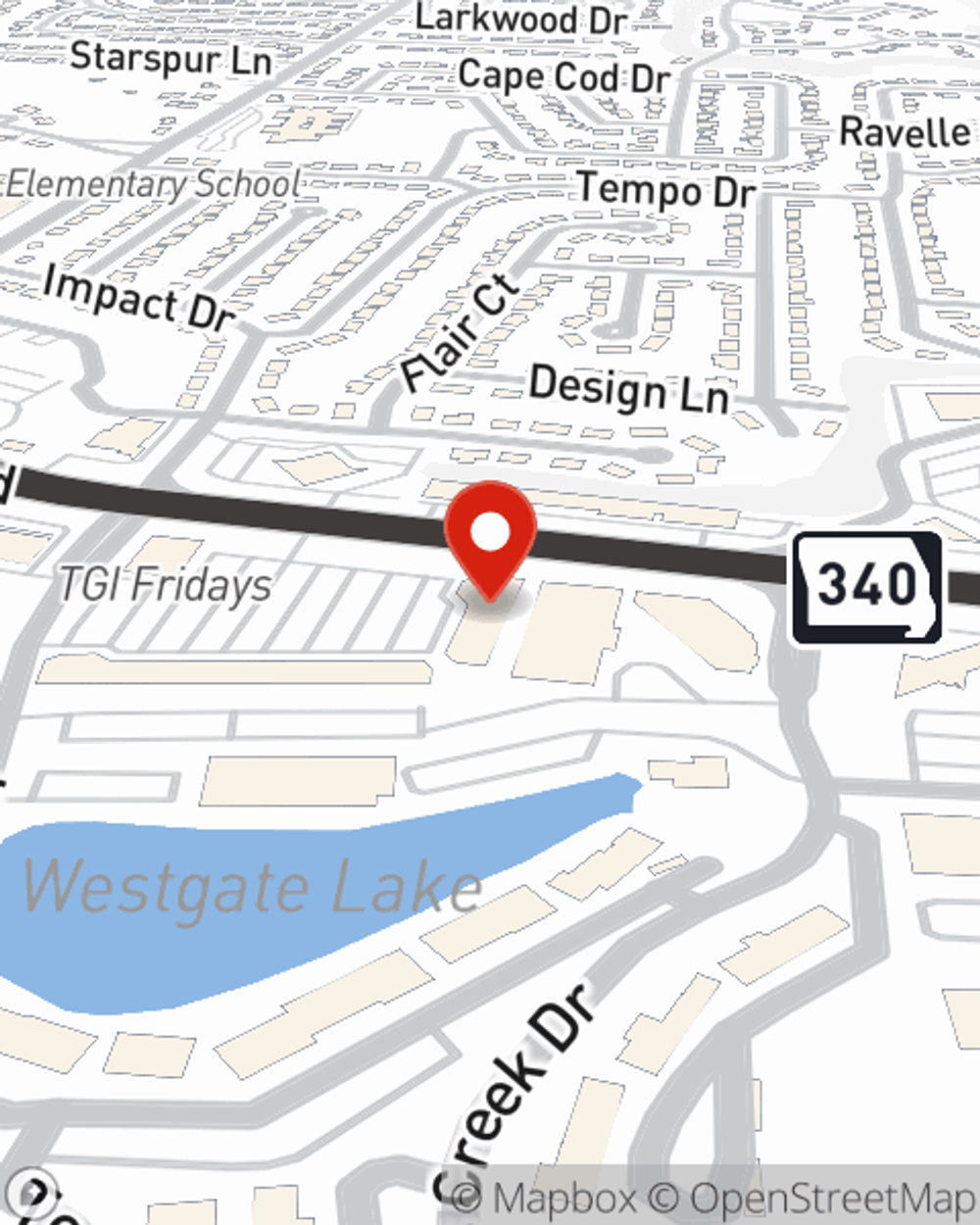

Business Insurance in and around Creve Coeur

One of Creve Coeur’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Coverage With State Farm Can Help Your Small Business.

It takes courage to start your own business, and it also takes courage to admit when you might need support. State Farm is here to help with your business insurance needs. With options like a surety or fidelity bond, errors and omissions liability and worker's compensation for your employees, you can rest assured that your small business is properly protected.

One of Creve Coeur’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Surprisingly Great Insurance

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Deanna Carroll for a policy that protects your business. Your coverage can include everything from a surety or fidelity bond or errors and omissions liability to mobile property insurance or commercial auto insurance.

Ready to discuss the business insurance options that may be right for you? Get in touch with agent Deanna Carroll's office to get started!

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Deanna Carroll

State Farm® Insurance AgentSimple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.